When your new Capital One card arrives, you must activate it before you can use it. Activation is quick and only takes a few minutes. Once activated, you can start using your card for purchases, rewards, and account features.

You can activate your Capital One card online, through the mobile app, or by phone.

Activate Your Capital One Card Online or in the Mobile App

The easiest way to activate your card is by signing in to your Capital One account.

Follow these steps:

-

Sign in to your account at capitalone.com

-

Or download the Capital One Mobile App from your app store

-

You can also text MOBILE to 80101 to get the app download link

-

Choose the account linked to your new card

-

Look for the Activate Your Card button

-

Follow the on screen steps

-

Set a PIN if prompted

Once completed, your card is active and ready to use.

You can manage your account and card settings anytime through Capital One Online Banking.

Activate Your Capital One Card by Phone

If you prefer not to activate online, you can activate your card by calling the automated phone system.

-

Call the phone number printed on the back of your Capital One card

-

Follow the voice instructions

-

Enter your card details when asked

This option works well if you do not have internet access.

If You Already Have a Capital One Credit Card

If this is not your first Capital One card, you need to link your new card to your existing account.

What you should do:

-

Sign in to your Capital One account

-

Follow the steps under Consolidate Your Accounts

-

Once linked, activate your new card as usual

After linking, you can manage all your Capital One cards from one dashboard.

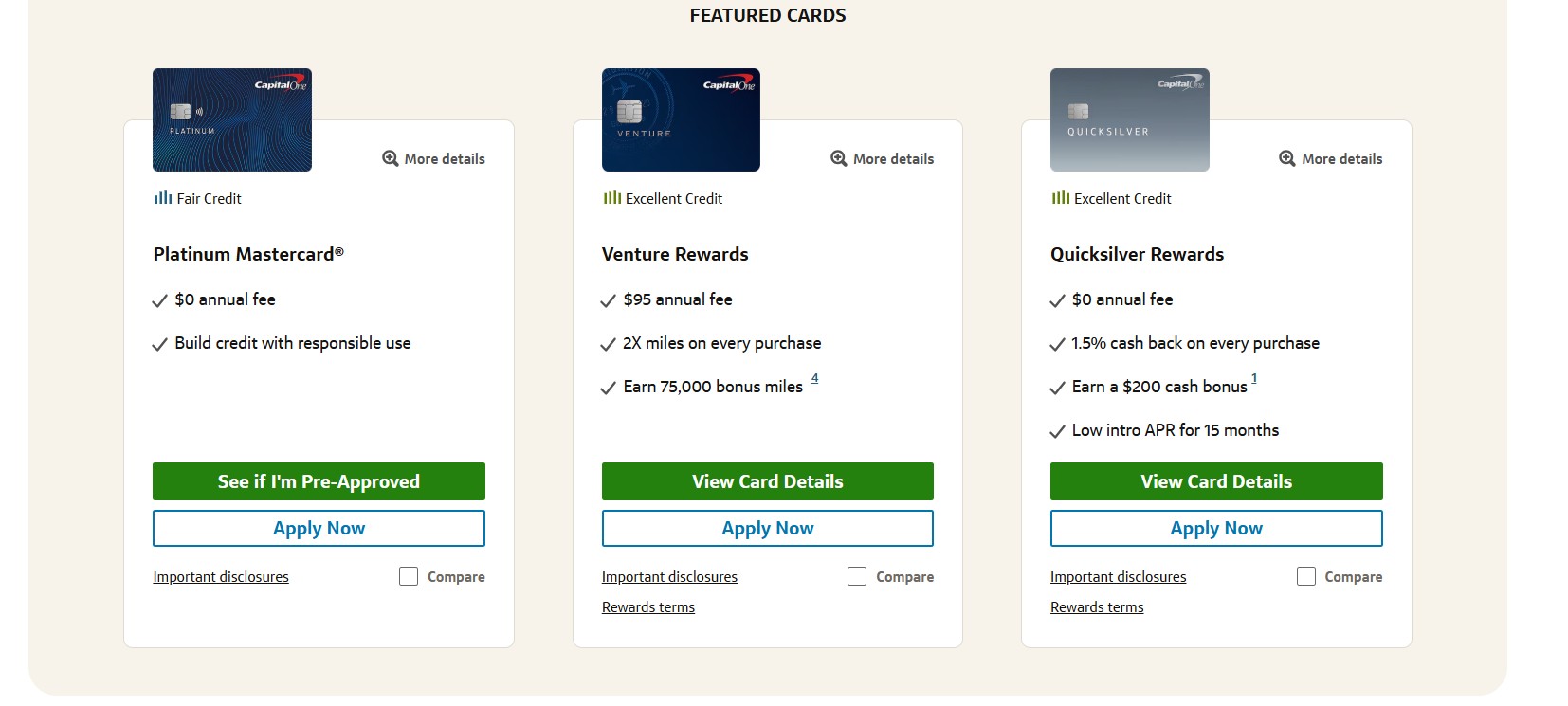

Benefits You Get With a Capital One Card

No annual fee

You can get the credit you need without paying an annual fee on many Capital One cards.

Automatic credit line reviews

You are automatically considered for a higher credit line in as little as six months with responsible use.

CreditWise access

You get free access to CreditWise, which lets you:

-

View your credit score

-

Monitor your credit profile

-

Get alerts about changes

CreditWise is free for everyone, even if you do not have a Capital One product. Learn more at Capital One CreditWise.

Fraud protection

You receive zero dollar fraud liability. If your card is lost or stolen, you are not responsible for unauthorized charges.

Tap to pay

You can pay faster and more securely using contactless payments. Just tap your card on a supported reader.

How You Can Manage or Get a PIN

A PIN is a four digit number you use for cash advances.

When you receive your card, you may:

-

Choose your own PIN

-

Receive a system generated PIN

-

Decline a PIN

Get or change your PIN online

-

Sign in to your credit card account

-

Go to More Account Settings

-

Select Control Your Card

-

Follow the steps under Get a Cash Advance

You may receive a verification code by email or text. If not, your PIN arrives by mail in 7 to 10 business days.

Get or change your PIN by phone

-

Call 1-800-227-4825

-

Follow the automated instructions

-

Request a new PIN or update your existing one

What a Cash Advance Is and How It Works

A cash advance lets you use your credit card to get cash. This can include:

-

Withdrawing cash from an ATM

-

Getting cash from a bank branch

-

Sending money through apps like PayPal or Venmo

-

Paying loans through third party bill pay services

-

Buying lottery tickets or casino chips

-

Exchanging currency

Important costs to know

Cash advances usually include:

-

A transaction fee

-

A higher interest rate than purchases

Fees post to your account on the same day as the transaction. Review your card terms so you understand how payments apply to cash advances.

How to Get a Cash Advance With a PIN

At an ATM:

-

Insert your card

-

Enter your PIN

-

Follow the on screen instructions

-

Check ATM fees before confirming

You must have:

-

Available cash advance credit

-

Available total credit line

Even if you have cash advance credit, you cannot take one if your total credit line is maxed out.

How to Get a Cash Advance Without a PIN

You can visit a bank lobby that displays the Visa or Mastercard logo.

Bring:

-

Your Capital One card

-

A government issued photo ID, such as a driver’s license

The teller can process the cash advance for you.

Frequently Asked Questions

1. How long does Capital One card activation take

Activation usually completes within minutes.

2. Can you activate a Capital One card without the app

Yes, you can activate online or by phone.

3. Is a PIN required to activate your card

No, but you may need a PIN for cash advances.

4. Does Capital One charge for fraud protection

No, zero dollar fraud liability is included.

5. Is CreditWise really free

Yes, CreditWise is free for everyone.

6. Should you use cash advances often

No, they usually cost more than regular purchases.